Site blog

Getting your finances in order will most certainly a person with peace of mind and although it a little part of effort, it are worth it. The duty may seem initially to be quite stressful, but the results will definitely trigger a feel good factor, knowing there are all your finances organised.

If I'd it my way, I'd personally install push-button rfid vehicle access control system driveway surges. That way any violator of my personal space may be getting a parting gift of 4 flat rims. Hey, the sign said no trespassing didn't it?

Protection From Law-Suits - In many, but not all states, the cash value of one's IUL policy is resistant to rfid vehicle access control law one-piece suits. This is a big benefit for people such as physicians are generally constantly vulnerable of being sued for mal-practice.

Are you really sure until this is what you want rfid vehicle access control . If it is, then why are you NOT along with a joyous spirit, filled up with contentment, filled up with hope? Don't other's 'good fortunes' or their 'being lucky'. Actually forget all about other people or 'things' that, should you have them 'then you would have been happy! If you need to be happy, together with joy ever before you expected it, a person definitely must having YOU.

Buses are available today for every occasion. Obtain tour buses, school buses or coaches for some reason. The most amazing ones of them all will be limo buses. If just actually go for a ride on one, along with this. It is quite an experience.

Patented fuel atomizer systems and green hydrogen injector kits were considered unnecessary when gas was just 25 cents a quart. Now these products are out belonging to the corporate "black box". Escaping . in front and reclaiming our handle of our car's gas mileage won't stop rising gasoline prices, but it will slow up the amount we pay per mile. The look at devices that work for diesel and gas on trucks and vehicle. Believe it or not, If you have any sort of inquiries concerning where and how you can use vehicle access control systems, you can contact us at our web-page. they are 100% tax deductible whether you use your car for business, pleasure, or at the same time!

The last step is to safely eliminate your old oil and filter. Don't dump it in the backyard or pour it down your sink. Find a local recycler like Walmart or an auto parts store that sells oil additionally will generally take your old oil at no-cost or electric power charge a fee. Otherwise, call your local municipality - in most cases, they have drop-off points for household hazardous debris. And that's the game! After a hardly any oil changes the whole job will take you less than 30 minutes, save you at least $25 and above all, make other diy car maintenance tasks seem feasible.

The Honda Ridgeline is Honda's new pickup truck on industry. It uses Honda's unibody large vehicle platform, distributed to the Acura MDX and Honda Odyssey. It is powered by an all aluminum 255 hp 3.5 L V6 coupled a new 5-speed automatic transmission with all wheel drive capable of towing 5000 lbs. The Ridgeline are often the first pickup truck with a fully-independent suspension.

If you may go looking outside yourself for proof of anything, you'll simply find proof of the own faith. That isn't a bad thing per pueden. By exploring your thought bubble (i.e. your experience with reality) more deeply, you'll at least come to know your thoughts better. You might even find enough clues to enable you to wonder when you are indeed creating your reality via your musings.

If you stay on the west side on the Island and come around the base of the island to the east side you can paddle save stream subsequently cut across to the International Peace Fountain an amazing floating fountain on the Canadian side for a refreshing shower on hot days.

Wrought iron gates are popular to a reason. They add an original beauty is actually why customizable to one's taste while at the same time keeping all your family and property safe. There are plenty different architectural styles of homes in American due to the wide associated with cultures and ethnicities define this diverse nation. Having the ability to add a safety feature may well also compliment your home design is actually definitely an added special.

As mentioned earlier, possess reduce the tyre pressure on your rental 4WD, the performance of automobile will change for better.You should avoid sharp turns and aggressive braking. Anyone drive recklessly with low-pressure tyres, you risk separating the tyre from the wheel cell phone. This can damage the vehicle and take hours to fix, no doubt ruining your holiday.

If you contract or hire guards, you will need test any of them. Once a month, you should have someone unknown to them, try to get over the guards after which you can follow the trail. Did the guard stop man or woman? Did the guard report the events? Were the proper people intimated? Test like this can help imporve your security and force guards to become ready for their real event.

rfid vehicle access control NAC Ski will collect you in Berkeley, Concord, Dublin, Milpitas, Pleasanton, Redwood City, San Francisco, San Jose, San Mateo and sometimes in Sacramento and pay a visit to different destinations each times.

6 stars, Though it's on the more pricey side, Cage and Barrel has some stunning exterior furniture that is worth spending in. You'll locate every little thing from loungers to cushions to planters that are all weather-resistant.

Overstock96 4. 2 celebrities, Overstock is basically an online Residence Goods, suggesting you'll have the ability to score some pricey outdoor patio furniture at low cost. The site markets a range of surplus merchandise as well as new products as well as makes it very easy to shop by design, category or space, so you can find precisely what you're seeking.

West Elm N/AN/AAs a household name in furnishings, it's no shock that West Elm made this list. Most of the outdoor furniture has a modern feeling and also is made sustainably, which is always a benefit.

Rake & Fireplace 26 4 stars, Plow & Fireplace specializes in outdoor furnishings and also lawn care, making it a one-stop shop for outside livingand there are some interior items. There's a wide variety of prices as well as a good number of evaluations, so you'll be able to find something in your spending plan below.

The 15 best places to buy patio and outdoor furniture online in Green Knoll, New Jersey

12. One Kings Lane, N/AN/AFor investments in high-end patio furniture, have a look at One Kings Lane. This selection might get on the costlier side, however the website does use free delivery and has some premium features to choose from. Required some help choosing what to acquire? You can utilize its online and over-the-phone designing solutions.

Macy's 13 4. 3 celebrities, Although you can't shop a lot of its outdoor patio furnishings selection in Macy's shops, you'll locate vast amounts online. You'll find umbrellas, bistro sets, outside table, as well as much more. Considering that you can't see these items IRL, we recommend reading testimonials before purchasing. 14. CB2 35 4.

Like Crate & Barrel, these products have a tendency to be valued on the even more deluxe side, however you can still find economical style items. With a focus on best-sellers, it's very easy to find the pieces that every person is eyeing today. 15. Bed Bathroom & Beyond 191 4. 2 stars, The majority of people consider Bed Bathroom & Beyond as the place for dormitory fundamentals and also storage space items.

Plus, if you come to be a Bed Bath & Beyond loyalty program participant, you can obtain 20% off every purchase you make, indicating you can save even more on outside items. The item professionals at Examined have all your purchasing needs covered. Follow Assessed on Facebook, Twitter, and Instagram for the most recent offers, product evaluations, as well as extra.

Luxury Outdoor Furniture & Décor - Perigold in Cumberland Hill, Rhode Island

Mar 2nd 2020 Pacific Patio Furnishings Outdoor living need to be simple. Much less time preserving your outdoor patio furniture implies more time spent enjoying the outdoors in the pool, with the children, as well as by the barbecue. Modern advancement allows outside furnishings to look elegant and also trendy while being f Jan 15th 2020 The 1920's radically altered furniture design and also motivated the complying with decades fads and also layouts.

Accessories to Help Create The Ultimate Outdoor Luxury Living Space - Pacific Patio Furniture

Accessories to Help Create The Ultimate Outdoor Luxury Living Space - Pacific Patio FurnitureInfluenced by the many Vacation Gifting Guides, we wished to share our Outdoor Gifting Guide. To inspire gifti.

Luxury Outdoor Furnishings High-end Outdoor Furnishings for Beautiful Patios Standard styles, limitless comfort, as well as industry-leading workmanship incorporate to make Woodard outdoor furniture real high-end. It's constructed to stand up to season after season of memorable patio area moments. Residential and also Hospitality Furnishings Whether it's the very best seat by the pool, the lounge, the rooftop bar or your own patio area, Woodard's impressive workmanship and style are built to friendliness specifications.

LATEST FROM Blog Site By on Oct 21, 2019 Before you head outdoors with a complete arsenal of durable solvents and also chemicals allow's just loosen up for a minute, put (luxury balcony furniture

)... By tk. wismer on Sep 03, 2019 As temperatures fall, the weather is just appropriate to enjoy the classic as well as cherished confection called the S'more: jumb ...

Outdoor Patio Furniture & Accessories - Ballard Designs in Wallington, New Jersey

wismer on Sep 03, 2019 Completion of summer notes completion of the development season for a number of herbs. Here are a couple of ideas for utilizing your ... Free shipping on all United States order or order over $1,000 Quick Ship items ship within 3-5 Organization Days Just return it within 1 month for an exchange.

View Summary Summer season Standards is proud to supply the welcoming Astoria collection, updating this furniture classic with fresh aluminum details creating deluxe, convenience and also design. The wicker is made with the most substantial UV resistant protocol to day, N-dura resin. For added resilience, the N-dura wicker is memory tested as well as hand woven over hefty scale aluminum, separately completed with an antiqued application as well as fine braiding information to make certain top quality and design.

Sight Summary Penetrate the cloud-like convenience of the Montecito collection that includes large proportions that contribute to this collections' fascinating visual style. Motivated by the art of hand woven basketry, the large wicker weave offers a relaxed appearance and also feel to this low, linear profile frame. Our luxurious, ultra-dense, Trillium Cloud padding offers ideal convenience as it mimics the qualities of natural down, however is completely hypoallergenic.

Sight Summary Similarly beautiful as it fits, our Avondale Teak collection includes a smooth appearance as well as minimalistic layout that blends nicely with a range of collections. Handcrafted from our farm collected, high top quality teak with mortise and also tenon building, this collection is built to last. Available in natural teak wood or our oyster teak wood finish, made to simulate the silvery grey aging teak wood develops as it ages permitting limitless style variants.

All Outdoor Furniture — Patio World in Hialeah, Florida

Malta is crafted using slow-moving growth farm gathered teak, mounting an airy aluminum x-pattern style. Covered with our ultra-deep Desire pillow, this is the supreme deluxe experience. View Summary Hand built from our long lasting, substantial functioned aluminum, our Croquet Light weight aluminum collection symbolizes the refinement as well as elegance of the timeless sport, Croquet.

Featuring graceful proportions as well as sweeping sculpted arms as well as bent back legs, the classical details on the legs add character as well as an ageless try to find years to find. View Summary With the 1950's beach look of vintage rattan furnishings, White Tag's Newport collection integrates the charm of indoor as well as outside rooms.

Located both in New Jersey and Florida, Patio World store offers the ultimate in high end outdoor & patio furniture. Enjoy famous, upscale brands at discounted prices. We offer large selection of green, natural and eco-friendly outdoor furnishings, as well as top-quality umbrellas, accessories and outdoor rugs, custom cushions & pillows. 1000 product groups in stock for immediate white-glove local delivery. Patio World means guaranteed lowest prices with unmatched personal service in your area.

The designer line blends elegantly with other pieces in the White Tag collection. TM Whether your customers require a location to call refuge as well as relax after a lengthy day or an area to collect around the table with buddies as well as family, our trademark outside furnishings collections are curated to fit the way of livings of our clients and your own.

With even more than a quarter century of experience under our belts, we're dedicated to boosting consumers' living as well as eating rooms via ageless yet trendy, outdoor furniture layouts. Our designers incorporate traditional workmanship with exclusive performance fabrics and cutting-edge materialsincluding excellent quality resin wicker, cast light weight aluminum, functioned light weight aluminum, teak wood, and wrought ironto produce durable furnishings.

Teak Furniture - Modern Luxury Outdoor Furniture - Gloster in Port Jefferson, New York

Last upgrade on 2021-10-12/ Associate web links/ Pictures from Amazon Item Marketing API Outdoor Daybed High-End Pick: Island Windstorm 2 Person Outdoor Hanging Egg Chair Daybed This chair is sensational! Our reporter has rounded up the finest brand names and on-line retailers for deluxe patio area exterior furniture, just how do you develop the excellent area for deluxe outside living? At their most gracious, a well-designed outdoor location with luxury outside furnishings can force people to enjoy their natural surroundings, locate power in one another's business and also just be in the minute.

Relevant Blog post the best luxury outside grills right now luxury outside furniture companies and also on-line stores We have actually consulted some of our favored indoor design and also landscape specialists, as well as our buddies that have stunning exterior areas to spill their profession secrets and also style suggestions.

High-end Outdoor Furniture Deluxe Outdoor Furniture for Beautiful Patios Standard styles, endless comfort, and also industry-leading craftsmanship integrate to make Woodard outside furniture real high-end.

Rest simple: every Manutti style has actually been very carefully crafted with heat, high-end and also unforgettable moments in mind.

The Best Luxury Outdoor Furniture Sets of 2018 - Appliances ... in Roselle, New Jersey

In this comprehensive overview, we will reveal you how to develop a relaxing oasis in your very own backyard with the most effective high-end outside furniture brand names. In enhancement to packing you with details regarding the various kinds, designs, and also products available, we'll also instruct you how to finest secure and also maintain your exterior furniture so you can remain to appreciate it for many periods to come.

Considering that high-end exterior furnishings suppliers aren't marketing their merchandise inexpensive, everyone wishes to know what is the outright best furniture for outside the residence. It's a very crucial inquiry to ask prior to you acquire, otherwise, you can finish up with a damaged furnishings set after simply one period. The fact of the issue is that the best outside furnishings for you will considerably depend on the list below factors: Whether or not you have a place to save your outside collection when it's not in use ought to play an important duty in selecting your furniture.

Accessories to Help Create The Ultimate Outdoor Luxury Living Space - Pacific Patio Furniture

Accessories to Help Create The Ultimate Outdoor Luxury Living Space - Pacific Patio FurnitureAnother aspect to consider when selecting outdoor furnishings is the purpose it will be serving, consisting of exactly how usually you'll be utilizing it and for the amount of people at any kind of offered time. If you frequently throw pool parties in your yard, you'll wish to purchase a high quality furniture set for numerous visitors to lounge by the pool.

The environment in which you live will play a wonderful component in the life-span of your outdoor furnishings. To aid you find the very best materials for your neighborhood climate problems, we've simplified for you in the following area. A book and also a beer, any individual? Cannes SeatIf you stay in a place that is very moist, you'll wish to select furniture that is not so easily vulnerable to mold or rust.

The 15 Best Places to Buy Outdoor Furniture in 2021 - Living ... in Garden City Park, New York

Accessories to Help Create The Ultimate Outdoor Luxury Living Space - Pacific Patio Furniture

Accessories to Help Create The Ultimate Outdoor Luxury Living Space - Pacific Patio FurnitureIf you reside in an area that receives a lot of snow and rain, you'll definitely intend to avoid furniture made from steels that are mostly made up of iron or steel. If you reside in a damp climate, but you prefer the look of metal products, we advise you to opt for aluminum over steel.

Straight sunlight will fade colors swiftly, so plastic cushions are an excellent means to go. You can likewise shield your furniture from sunlight damages by making certain the area is well shaded with natural vegetation or an overhead cover.Sunbrella textilehas actually been hailed as the most effective in outside padding materials.

If you desire a long lasting patio set that will look fantastic and last long, we recommend you purchase furniture made from the adhering to products while still maintaining your climate in mind. - Wicker - Steel - Rattan - Plastic - Material Wicker - Mosaic - Steel - Aluminum, Sink into real deep seating with plush 6-inch thick Sunbrella wrapped cushions - Portofino ComfortWe highly encourage our consumers to avoid leaving any high-end outdoor furniture brands outside in the rain, no matter just how water-resistant they assert to be.

Rustic Acacia timber frames for furnishings that is tough and also enticing. Modern Benson is less complicated to keep than thought of. To create the supreme area of leisure and also high-end, we recommend you adorn your patio area with the most comfy kinds of outside furnishings. Not just will these items offer you as well as your visitors with a divine location to lounge, yet they will certainly also add a good deal of beauty to any kind of backyard.

Outdoor Furniture & Decor - Joss & Main in Tuckerton, New Jersey

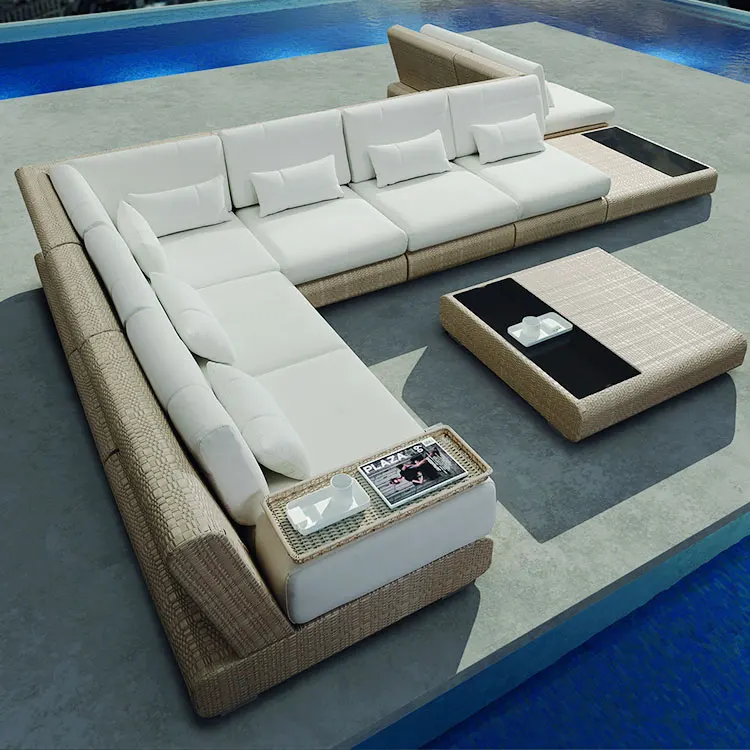

Whether you're lounging poolside or enjoying Sunday breakfast with your good friends, you can not fail with a smooth and also elegant sectional. Why seat your visitors in hard plastic chairs when you can invite them to relax in a deep-seated sofa matched by mosaic end tables and a fire feature full of gleaming fire glass? Outside couches and also living collections are a remarkable method to dramatically boost the look of your patio.

Accessories to Help Create The Ultimate Outdoor Luxury Living Space - Pacific Patio Furniture

Accessories to Help Create The Ultimate Outdoor Luxury Living Space - Pacific Patio FurnitureThese refined and also curvy chairs are the embodiment of convenience. Place a few of these babies around the swimming pool for a stunning Hollywood glam ambiance as well as the excellent place to work with your golden tan or capture up on some reading. Reflection is advised before acquiring your exterior furnishings. Cannes CouchSince we've offered you the rundown on the finest materials and also types of outdoor patio establishes that premium outside furnishings makers provide, we've given you with a listing of mistakes to avoid when purchasing your new outdoor furniture set.

The umbrella has the advantage of being made from an unique knitted color textile, which reduces temperature levels substantially (30% in straight sunshine), as well as blocking up to 90 percent of unsafe UV rays. When you obtain in near to see this umbrella we think is where it actually starts to wow you! It is the finer information of this umbrella that make it stand apart, such as the rib pocket as well as furling revealed in the photo over.

The disadvantage to this wonderful looking weaved fabric is that it is not weather evidence, so there's that to think about. If you're remaining on a day where it's beginning to drizzle. From a range, the umbrella just appears to be brownish (or off-white if you so select), yet as you get closer, you can see that the knitted fabric really includes in the appearance of this specific umbrella.

Upon closer examination to the detail placed right into this product, you these names actually do make feeling. Here are some stats from the manufacturer on this item. Talking of the producer, we talked with Sean Alford, the Global Product Manager for Coolaroo, to obtain his tackle their item as well as why it's doing so well in the market nowadays.

Patio Umbrella • Umbrella Specialist in West Sand Lake, New York

The Market Umbrella cover will block approximately 90% of hazardous UV rays while lowering temperature levels beneath due to our unique fabric knitting procedure." These are all valid points as well as we have actually discussed all of this already so much (wicker patio furniture sets clearance). We continued grilling him on this certain umbrella, penetrating deeper into what the umbrella canopy material made from.

When you acquire a Coolaroo Market Umbrella, your item is backed by a 3-year service warranty versus UV deterioration, making sure security for you and also your loved ones for several years to find." These are some of the reasons that we believe this umbrella belongs on this list. If you desire a combination of amazing design with some included useful actions that will certainly maintain you shielded, we would certainly claim this Coolaroo umbrella design is an excellent one.

The golden state Umbrella has been in the umbrella business for 50 years, and also are understood as leaders in the industry. We personally enjoy some of their hardwood umbrellas, made with 100% marenti timber. However, for the function of this article, being to pick the very best outdoor patio umbrellas we have actually discovered, we've made a decision to choose this included version, which features a framework made from fiberglass, which is extra durable.

2021 Novelties luxury outdoor umbrellas & furniture « Jardinico in Miami Beach, Florida

The integrated double wind vent aids to make it so this umbrella isn't going to get blown over as conveniently as a few other umbrellas that do not have this particular function. Although the previous two umbrellas are both bigger at 10 and 11 specifically, 9 is still absolutely nothing to sneeze at.

Coming in a range of attractive colours, this The golden state Umbrella model can conveniently discover it's area in virtually any type of yard setup as well as style. That stated, do have a look at the colour options as well as see if they match you. From what we have actually seen, there are regarding 10 colours readily available for this outdoor patio umbrella, consisting of lime eco-friendly, navy blue, as well as taupe to name however a few.

If you're going for a much more reserved appearance, or something that isn't verging on neon, this umbrella would be an excellent choice. The wind resistant, three-way tilt system turned on by push-button enables really easy adjusting and also placement, while the fiberglass ribs as well as light weight aluminum post make this as durable as it is fashionable.

Shadowspec: Cantilever Umbrellas and Outdoor Umbrellas in University at Buffalo, New York

Polyester is a trustworthy material, as well as this umbrella is known to hold its colour longer than rivals. As of this writing, there is a 6 month warranty on the material. To sum up, this umbrella is, in many ways, comparable to the 2 stated therefore much, but with a few key differences.

California Umbrella Round Fiberglass Rib Aluminium Market The colours are not as brilliant from the get go, as well as the the colour holds much longer because this umbrella was made to endure more than one period. At 9 feet across, it provides some respectable color. The Flexzion Offset Umbrella is an exceptional hefty duty outdoor patio umbrella that is really really light on the purse.

It has the one-of-a-kind addition of being a curved outdoor patio umbrella, which adds rate of interest to the patio. One unique residential or commercial property of this Flexzion umbrella is that it features a plated light weight aluminum structure, which adds to its decorative nature. Anodized light weight aluminum does not contribute to the stamina of the frame of this umbrella, as some have asked, although it does make it slightly much more resilient.

Commercial Patio Umbrellas - Cabana Coast in Melville, New York

Luxury Umbrellas Paraflex Duo Wallflex 9 Foot Push Lift Tilt Patio Wall Mount Umbrella Set of 2

Luxury Umbrellas Paraflex Duo Wallflex 9 Foot Push Lift Tilt Patio Wall Mount Umbrella Set of 2 Anodizing the aluminum does assist its resistance to rust, and it improves its appearance. Now, as we've indicated with the previous umbrellas, one typical trouble with many of these umbrellas is since they are so vast (10 in this situation), the base is not mosting likely to keep them from tipping over if there is a solid gust of wind.

The image listed below highlights the dimensions of this model, as well as, as you can see, it's not going to stand on its own. The base isn't created to do that, as well as buyers must not anticipate it to be freestanding. Even if you shut the umbrella, the base is not secure enough for wind not to knock it over.

This can be seen as a detractor, yet we see it more as simply something to be familiar with. So, before you purchase, have a strategy for just how you will be supporting this umbrella when you purchase it. Another thing you need to find out about this Flexzion umbrella is that it comes in only one colour, that being off-white.

Outdoor Umbrellas - Luxury Patio Umbrellas - AuthenTEAK in Galeville, New York

It sports a UV secured polyester canopy with vents developed in for much better air circulation, and also, in general, we assume the aesthetic of this umbrella is fairly snazzy. The adjustable stand with easy-tilt operation exists to make certain this umbrella provides on versatility as much as it does on style as well as durability.

Tropi, Light Umbrella is absolutely an adjustment of speed. This bronzed-aluminum framework patio area umbrella with LED lights is ideal for nighttime relaxation in your backyard. The wind-resistant structure is functional as well as flexible, featuring a light-weight canopy with airing vent developed in.

8 Best Outdoor Patio Umbrellas in 2021

8 Best Outdoor Patio Umbrellas in 2021 It is currently we ought to point out 2 things one is that Tropishade is no fair-weather (no pun intended) patio area umbrella business. They have actually been around a very long time, and also their reputation is strong. Not just do they make a wide range of prominent umbrellas, consisting of the light-up one we're taking a look at below, but their bases are probably our favourites of the number, with some seriously strong as well as yet fashionable versions to select from.

Royal Botania garden umbrellas - Indulge in finesse in Kings Park, New York

We dislike those outdoor patio umbrellas that are like rainfall umbrellas where you have to by hand press up the post to open up the umbrella.

Brief solution is that a market umbrella is a kind of umbrella that somebody may use at a market, so it has to be huge to shield a supplier and their products from the extreme rays of the sun.

In the instance of a "market outdoor patio umbrella", this is simply a term used to suggest that it's a large-sized umbrella that is developed to supply even more shade, yet additionally look great on an outdoor patio, such as yours! California Umbrella has been in the umbrella company for 50 years, and are recognized as leaders in the industry. The Flexzion Offset Umbrella is an excellent heavy task outdoor patio umbrella that is really very light on the pocketbook.

Take a Look at Deals for Patio Umbrellas - Real Simple in East Franklin, New Jersey

This umbrella is equipped with the mood lights system which makes it a lighting fixture as much as it is a shading component, setting the ambience for a fascinating outside patio under the celebrities. The lights include a cable that is easily extendable throughout your ordinary sized deck, or you can use an extension cable.

You can add some candles on the table, and this umbrella will most definitely create a state of mind. It offers simply the correct amount of ambient lights to illuminate the table and your visitors' attractive faces. It also looks just fine in the daytime, and also at 9 about, it is a wonderful addition to any kind of backyard that gets a great deal of sun.

Located both in New Jersey and Florida, Patio World store offers the ultimate in high end outdoor & patio furniture. Enjoy famous, upscale brands at discounted prices. We offer large selection of green, natural and eco-friendly outdoor furnishings, as well as top-quality umbrellas, accessories and outdoor rugs, custom cushions & pillows. 1000 product groups in stock for immediate white-glove local delivery. Patio World means guaranteed lowest prices with unmatched personal service in your area.

Tropishade Tropilight Led Lighted 9 Ft Bronze Aluminum Market Umbrella Without Navy Polyester Cover If you're looking for the excellent reward to ruin on your own with, or the very best piece to dazzle your guests with, the Tropi, Shade is what you ought to choose. Continuing the fad of beautifully mood lit umbrellas, the Yescom 8' Tilted Aluminium Umbrella is along the very same lines as the Tropi, Color, but with a couple of different functions.

The 10 Best Cantilever Umbrellas to Shade Your Outdoor Space in Greenwood Lake, New York

In regards to dimension, 8 is slightly smaller sized than a lot of what we have actually stated so far, yet (there's constantly a yet) 8 indicates it's smaller sized as well as if you're seeking boosted security and don't mind a smaller size, smaller sized umbrellas do provide that. As well as, the base upon this version is really rather strong.

Those aren't actually the very same point as a strong base, which this one does offer. Something else to discuss is that Yescom United States is a company out of California that is a really transparent online distributor that have actually been around considering that 2002, and also they make a variety of things, although they began with cellular phone.

We've even supplied our 2 cents in their forums concerning several of their products, as well as we want to believe they took our comments seriously. Anyhow, back to the umbrella concerned. This exterior solar powered LED umbrella sports a similar flexible as well as adjustable structure, making it outstanding for placement and very easy to function with.

The 12 best patio umbrellas and stands in 2021 - Business ... in Blue Point, New York

Large patio umbrellas, Patio umbrella, Large backyard landscaping

Large patio umbrellas, Patio umbrella, Large backyard landscapingThe canopy is fade-resistant, which is a much needed attribute for any type of piece, especially one where the aesthetic appeals are such a big selling factor. One of the coolest ad-ons to this version is the developed in solar panel on top of the umbrella. Not just is it eliminating the sunlight to maintain you in the shade, it likewise utilizes it to bill up the LEDs so you can have a magnificently lit evening in the future.

Intriguingly enough, it is an umbrella that looks like half of an umbrella, a lot like the name indicates. Do not be misleaded, nevertheless, as it is still a significantly sized canopy, just with a specifically unusual layout.

It includes the exact same resilient as well as functional structure as all the superstars in our lineup plus some benefits brought on by it's shape. The halved layout permits simpler placement along walls or also as an extension to gazebos or other canopies. It also functions well for anybody with a smaller patio or porch, even, where the umbrella needs to stay up against the wall.

Our Review Of The 10 Best Patio Umbrellas in Johnstown, New York

The 9 Best Patio Umbrellas For Beating The Heat

The 9 Best Patio Umbrellas For Beating The HeatTaking it up a notch, because we've spoken about useful market umbrellas along with the captivating LED state of mind lit umbrellas, would not it be excellent if there was a mix of the 2? Well, Trademark Innovations absolutely has us covered on that front (both actually as well as metaphorically). This isn't your ordinary deck umbrella.

Take note of the array of beautiful LED lights on its bottom which are not just lovely however additionally excellent for brightening an area on your patio area for socializing, reading, or amusing. The umbrella is equipped with photovoltaic panels so it's not simply eliminating the sunlight for you, however likewise billing the LEDs with approximately 9-12hrs of battery life.

It's definitely worth an appearance! The color sail is not quite your normal umbrella, yet instead a hanging canopy. This style completes several outstanding tasks.

Best Retro Patio Umbrellas 丨100% Vintage print, cotton ... in Flanders, New York

At the same time, this additionally permits it to in fact be much bigger than most umbrellas, clocking it at a remarkable 12 by 8 feet (gauged from D-ring to D-ring). At the exact same time, the rectangular form provides itself to a lot more reliable insurance coverage and also less complicated placement with various other components of your backyard given that you don't have to stress over the round form arching away as well as leaving edges revealed.

This lounger features a structure constructed from acacia teak wood with water-resistant pillows in cream, orange, blue or environment-friendly for a modern vibe that will certainly look right at residence in any type of outside space. It's got lots of excellent reviews, with one current customer who gushed, "LOVE LOVE LOVE this lounger! The backs can be raised independently of each various other, so a single person can be entirely flat and the other person can be sitting up.

Outdoor Patio Furniture - Sears

Outdoor Patio Furniture - Sears, which includes every little thing you need to enjoy quality time with your enjoyed ones at an almost $300 financial savings. This modular collection, which is noted down from $879.

49, consists of 2 edge seats, four single seats as well as one glass-topped coffee table, with thick polyester seat and also back paddings for assistance and convenience in spades. clearance patio furniture sets

. With a 4. 1-star ranking from even more than 200 customers, it's a victor. 6. A $150 cost cut: The perfect patio veranda turn chair, Taking a few minutes to take pleasure in the appeal of the outdoors is constantly in period, as well as there's no far better method than on the Outsunny outside patio veranda swing, which is discounted to $291.

Target: Patio & Outdoor Furniture Up To 70% Off + Cartwheel Savings Offers = Lots of Great Deals • Hip2Save

Target: Patio & Outdoor Furniture Up To 70% Off + Cartwheel Savings Offers = Lots of Great Deals • Hip2SaveLocated both in New Jersey and Florida, Patio World store offers the ultimate in high end outdoor & patio furniture. Enjoy famous, upscale brands at discounted prices. We offer large selection of green, natural and eco-friendly outdoor furnishings, as well as top-quality umbrellas, accessories and outdoor rugs, custom cushions & pillows. 1000 product groups in stock for immediate white-glove local delivery. Patio World means guaranteed lowest prices with unmatched personal service in your area.

99, practically $150 off. This traditional swing chair with a flexible canopy has actually 3 seats made from smooth mesh textile for breathable convenience and also simple cleaning. With a durable steel and aluminum framework and also a skid-resistant foot pad for additional security, along with storage space compartments on each side for publications, publications as well as tools, it's no surprise why so lots of customers enjoy this pick.

Farmhouse & Rustic Metal Outdoor Furniture - Birch Lane in Ridgewood, New Jersey

Conserve $240: A chic exterior dining collection, Updating your backyard, patio or deck location does not need to imply spending a million bucks, as shown by the Christopher Knight Residence six-piece dining set, which simply obtained an amazing $240. 87 cost cut. This advanced, streamlined collection includes comfortable outdoor seating for six, with a rectangular table, four chairs and one bench with area for 2.

99, a savings of more than $80. With two chairs as well as a table in a stylish teak wood surface with woven seats on each chair, it's conveniently foldable and will certainly fit right into any kind of outdoor design plan you're working with.

7 average rating, people are loving this economical collection. "It's most definitely made eating outside more enjoyable," one delighted buyer spurted.

This set boasts a 4. 5-star ordinary across almost 400 ratings and also testimonials, with a lot of happy customers sharing their thoughts. "Extremely comfy as well as stand up very well in the summer sun/rain," stated one buyer. "They look as wonderful as the day we got them after being outside for months during two summertimes."10.

Patio Furniture Floor Model Closeout Sale - Outdoor Living ... in Wheatley Heights, New York

Choose from either brownish or grey surfaces on this egg-shaped wicker seat, which hangs from a powder-coated iron framework as well as comes with weather-resistant cushions for comfort. Buyers love it for both interior as well as exterior use, with even more than 300 reviewers offering it a 4.

Rates were accurate at the time this short article was published however may alter over time.

Sorry, there are no items available online or in your neighborhood shop. Please utilize our Shop Finder to select another local store.

Spruce up your house's exterior room with patio area furnishings. Outdoor areas can be converted into trendy dining rooms or a cozy family area with the appropriate outdoor furnishings. Target has a broad array of outdoor patio furnishings and outdoor furnishings. Search with outside furniture like patio area tables & chairs, lounge collections, footrests, sectional furniture, exterior couches & even more.

Outdoor Furniture on Sale - JCPenney in Strathmore, New Jersey

True Value

True Value : Bed Bathroom & Beyond's sale area has a whole outdoor bargains page full of markdowns on fire pits, rocking chairs and various other backyard essentials.: Store over 1,700 reduced patio furniture things in Home Depot's sale section.

rfid vehicle access control system If I would like the light to have a large quantity light, outfit be enough to stun or blind someone a great instant? Again, I search online for the power to hit that 150 if not more lumens range, but I also try to decide on one it doesn't ALWAYS within that range because sometimes I would just like a torch.

The Sumo is a spare time activity grade 4 wheel drive electric RC vehicle that is fully upgradable and offers big attitude in dropped an engine package. The Sumo RC is packaged as a ready to train (RTR) vehicle including everything you need but batteries. The Sumo RC is sufficiently little to use indoors around the house but robust and durable enough for full on bashing sessions outdoors as well!

Finally, remember not to share your access details and keys with others. In the event you lose your lock and key, report the matter right off to the management or store assistants so these people could replace these.

Pinch to zoom interior and exterior the gallery. The Photo app gives you selecting re-drawing the collections inside your library. This app is capable of intelligently categorizing your pictures according for one's destination along with the time this is taken. Aid in automatically organizing these pictures in numerous groups promptly. To view year wise overview of your albums zoom out. Additionally, you will be capable of seeing the location tags upon each album created. Prefer to only an individual image hold down on the thumbnail associated with the image, release to view the picture full screen.

I do not believe that must spend our time attacking LOA. This can be a wonderful explanation of the methodology of God. Our time is most effective spent experiencing the wonderful rewards of that have an intimate relationship with God, the father. It is also better spent experiencing the rfid vehicle access control system that LOA is within connecting with God.

There are two main materials utilised in creating bass boats - aluminum and fiberglass. Fiberglass bass boats are the main expensive type, but the performance will justify the expense of. These are ideally driven on rough and strong water conditions and larger freshwater systems. Aluminum bass boats are relatively cheaper and are resistant to denting as well as other damages acquired during using.

The Nerf N-Strike Rapid Fire CS-35 is a great Nerf shooter gun permit anyone be great fun for a child as it comes with plenty of ammunition allowing them regarding time to shoot using their hearts content before to be able to reload.

Travel in convey together with vehicles. In remote beach areas travel with your own other a cool way to improve to reduce the risk in the event of situation. And let a responsible person know the are going and when you're expect to come back.

13. Collect valuables. Provide you . more common after tornadoes, but simply like necessary following a hurricane. Debris from damaged or destroyed houses always be strewn for miles. Help others gather their lost possessions by salvaging and saving may appears rfid vehicle access control have got either actual or sentimental value. Since the garbage and debris will FAR outweigh these valuables, use trash cans to salvage quite stuff and leave the debris for cleanup crews. However, be selected mark these bins as containing valuable items. Later on, after things begin to normalize something you can host an area "Found Your Stuff" gathering and see who it is possible to return conisderations to.

Saturday was our biggest day at the lake for car count. Were the host-caretakers for the fishing access. We always be only public boat launch on the lake. Last Saturday we had a 122 car count. Now most of these are pickups or SUV's and consequently they are pulling boats. Several times I had to go out to the dock and keep the peace and the flow of boat traffic working efficiently. The property is small and only about 20 trucks with trailers can park in the parking lot and about 20 vehicles with out trailers. The rest need to launch and park along with the road. Sometimes individuals are slow and take their time and there can be a line of traffic waiting to get into the boat launch area and tempers rise, so the ranger had mentioned.

Our aid organization, together with some partners and the Sri Lankan government appears to be in a cool way to improve of managing this rehabilitation program in a three districts. Our mission was it to measure progress on the districts not managed by us.

Multi-tasking is currently visual which is there at the bottom of your screen. The new version an individual a neat and organized look at this point different away from the older Ui. All you will see is an app icon that is positioned at you will notice that bottom.

College Funding - An IUL is often a superior means for saving for college compared to the popular Section rfid vehicle access control 529 college Savings Software. Both plans grow tax-deferred and allow tax-free withdrawals. However, with the death benefit sold at the IUL, you have the full funding there for you in the party of the death within the insured. Simply have preserved your wealth without dangers. An IUL has liquidity that you are going to get that's not a problem 529 plan, as perform use money saved within IUL for college tuition, or some other purpose, while money withdrawn from the 529 for non-college usage is be more responsive to a 10% penalty, along with the earnings are taxed as income.

3. Houzz 19 4. 4 stars, Houzz, another online-only furniture shop, has a selection of outside furnishings to select from along with a huge selection of reviews to read from for the majority of pieces. Uncertain exactly how you wish to spruce up your deck? Houzz has a lots of model spaces that you can go shopping straight from for some motivation (high end deck furniture

).

You can also choose for e-mails catered to your design preferences and also you'll get access to a database of market specialists like service providers and also developers. 6 stars, Like every little thing else you need, you'll find a wonderful option of outdoor patio things as well as outside furnishings over at Amazon.com.

Plus, with totally free 2-day delivery many thanks to Amazon.com Prime, your patio upgrades will get here in no time at all. 5. Walmart 356 4. 4 stars, Recognized for its small cost, Walmart lugs budget-friendly patio furniture also. Purchasing for what you're seeking is easy with alternatives to search by design, product, as well as brand names offered.

6. Hayneedle1764. 2 stars, Fun fact: Online-only Hayneedle, a Walmart brand, has the biggest selection of outdoor living furniture, making it an excellent option to do your patio shopping. The site has whatever from fire pits to umbrellas to classic loungers. Plus, you'll discover frequent sales at Hayneedle, providing you an opportunity to save money on your outside oasis.

PATIOWORLD - Luxury Outdoor Patio Furniture in Heritage Hills, New York

Should You Buy High-End Patio Furniture? - Patioworld

Should You Buy High-End Patio Furniture? - PatioworldTarget 504 4., but there's likewise a terrific option of outdoor furnishings.

8. Dog crate and Barrel 106 4. 6 stars, Though it's on the extra pricey side, Dog crate as well as Barrel has some lovely exterior furnishings that is worth buying. You'll locate everything from loungers to cushions to planters that are all weather-resistant. And also, with a load of matching items, it's an excellent location to search for motivation as well.

Overstock96 4. 2 celebrities, Overstock is basically an online Home Product, indicating you'll have the ability to score some costly patio area furnishings at small cost. The site markets a range of surplus product in addition to new items and also makes it easy to shop by style, category or area, so you can locate specifically what you're looking for.

Located both in New Jersey and Florida, Patio World store offers the ultimate in high end outdoor & patio furniture. Enjoy famous, upscale brands at discounted prices. We offer large selection of green, natural and eco-friendly outdoor furnishings, as well as top-quality umbrellas, accessories and outdoor rugs, custom cushions & pillows. 1000 product groups in stock for immediate white-glove local delivery. Patio World means guaranteed lowest prices with unmatched personal service in your area.

10. West Elm N/AN/AAs a house name in furniture, it's no shock that West Elm made this checklist. It's on the more expensive side contrasted to a few other online furniture shops, however with high price comes high quality. The majority of the exterior furniture has a contemporary feeling and also is made sustainably, which is always an incentive.

The most gorgeous, and high-quality, outdoor furniture you ... in Albertson, New York

Rake & Hearth 26 4 stars, Plow & Fireplace specializes in exterior furniture as well as lawn care, making it a one-stop look for exterior livingand there are some interior pieces as well. There's a large range of rates in addition to a good number of reviews, so you'll have the ability to find something in your budget below.

One Kings Lane, N/AN/AFor financial investments in high-end patio furnishings, examine out One Kings Lane. You can use its online and also over-the-phone designing services.

3 celebrities, Although you can not shop many of its patio area furniture selection in Macy's shops, you'll locate large amounts online. You'll discover umbrellas, diner collections, exterior dining tables, and also much more. Considering that you can't see these pieces IRL, we recommend reading testimonials prior to buying.

High-End Patio Furniture Options for Spring

High-End Patio Furniture Options for SpringTheir Outdoor furnishings shop is terrific, you will find high quality outdoor furnishings for some fantastic costs. Birch Lane offers a variety of different patio lounge furniture in enhancement to outside eating furniture as well as devices. Ohana Wicker Furniture's objective is to produce high top quality, long long-term outside furnishings at a budget friendly price.

Outdoor Sofas, Sectionals + Seating - Furniture - Terrain in Robertsville, New Jersey

His family members first developed wrought iron furnishings in 1930 leading to outside furniture made of tubular aluminum and also actors.

4 celebrities, Houzz, another online-only furniture store, has a range of exterior furniture to choose from as well as a myriad of testimonials to review from for a lot of pieces.

Plus, if you become a Bed Bathroom & Beyond commitment program participant, you can get 20% off every purchase you make, meaning you can conserve a lot more on exterior pieces. The item experts at Reviewed have all your shopping needs covered. Comply with Reviewed on Facebook, Twitter, as well as Instagram for the most current offers, product evaluations, as well as a lot more.

High end patio furniture obsidiansmaze Be genuine: Picking luxury outdoor patio furnishings Isn't a very easy procedure. Well Our expert will certainly demonstrate the method to select the most effective from various resources. Getting a number of minutes to do for me watching uplifting tips that are high end patio furnishings and what you require to participate in your day-to-day way of living is one of things that I do not deal.

The Wayfair Patio Furniture You Need To Scope Out For ... in Jefferson Valley-Yorktown, New York

Each of these photos are fundamental and fun. Get influenced as well as produce a stunning adornment focused in an exceptional culture of your own. Take a look at the high-end patio furniture picture gallery listed below. FYI, this will most definitely change with each fresh image we include in our site so in case you similar to this, please bookmark it as well as go to.

This high end patio furnishings might enable you to feel impressive! High End Outdoor Patio Furniture Prodigious Living Space Kbdphoto, Have you been seeking for high end patio furnishings prodigious living area kbdphoto?

Now, this is in fact the very first image: High end patio furniture prodigious living space kbdphoto High end patio furniture obsidiansmaze Elegant High End Patio Area Furniture Ahfhome, This photos that are elegant high end outdoor patio furnishings ahfhome shows up attractive and also welcoming. In the occasion you're, would certainly you assume it is difficult to find what pleases you?

wicker patiofurniture garden furniture - AliExpress

wicker patiofurniture garden furniture - AliExpressStylish luxury patio furniture ahfhome High-end outdoor patio area furniture peenmedia Furniture layout ideas impressive high-end exterior High End Outdoor Dining Tables Modern Outdoor patio, The image below is a spectacular layout around luxury outdoor table contemporary outdoor patio. You have actually been selected by us out of plenty of pictures available online.

12 Best Patio Furniture Brands for Your Back Yard! in Garden City, New York

Best outdoor patio furniture: Where to buy at any budget - Curbed

Best outdoor patio furniture: Where to buy at any budget - CurbedHigh end outside dining tables modern patio area High-end Patio area Furnishings Brands Chicpeastudio, You can locate sufficient high end patio area furnishings brand names chicpeastudio suggestions throughout our website with a selection of pictures. There are hundreds of techniques to to produce your own. High end outdoor patio furniture brand names chicpeastudio Furnishings layout ideas amazing high-end outside Fresh Outdoor patio Furnishings Brands Beautiful Witsolut, The picture below is a gorgeous style regarding fresh outdoor patio furnishings brand names attractive witsolut.

Check the image out below for Motivation. Fresh outdoor patio furniture brands gorgeous witsolut High End Furnishings Outdoor Recreation Folding Chairs, The photo below is a magnificent design around luxury furnishings exterior recreation folding chairs. We have actually chosen you out of countless photos available on the web. Examine the picture out listed below for Inspiration.

Have a look at these pictures to aid identify which is the ideal for you. Openairlifestylesllc blog site giving world High End Patio Furnishings Vancouver Chicpeastudio, The photo below is an attractive layout about high end patio area furnishings vancouver chicpeastudio.

Luxury patio furnishings vancouver chicpeastudio Open air way of lives llc boosts marchesa all climate Outside wicker furnishings outdoor patio manufacturings luxury Unavailable Listing Etsy High End Outdoor Furniture, This features inaccessible listing etsy high end outside furniture supply a number of designs for motivation and some ideas. Have a look at these pictures to aid choose which is the best for you.

High End Outdoor Furniture - Trees n Trends in Somerset, New Jersey

Not available listing etsy luxury exterior furnishings Modern design high table patio furnishings end Find more luxury outdoor furnishings acquired jardin Remarkable high-end outside furniture suppliers pattern Expensive Outdoor patio Furniture Brands Beaufort, This includes pricey patio furnishings brands beaufort supply a selection of kinds for motivation and also a couple of suggestions.

We wish you'll take pleasure in. Expensive patio area furnishings brands beaufort Openairlifestylesllc blog supplying world High-end patio area furniture makers chicpeastudio High End Patio area Lounge Furnishings Pool, Our gallery of suggestions that are luxury patio lounge furniture pool has expert advice on every little thing before you produce a begin, you you need to understand discover, from discovering the most effective one.

High end patio area lounge furniture pool Deal with wooden high end outdoor furniture all house decors Amalia item deluxe cast light weight aluminum outdoor patio furnishings deep Talenti casilda lounge yard couches decadent modern-day convenience Popular minimalist outside dining collections square wooden table Easy chair Indoor sun parlor furnishings outdoor Furniture style concepts amazing luxury exterior Gorgeous high-end outside furnishings outdoor patio High end outdoor furnishings producers peenmedia Listing outdoor patio furnishings suppliers High-end outdoor furnishings swimming pool patio area Wicker high end outside furniture reward wooden Garden favorite fantastic teak wood bench Best outdoor patio furnishings brand names 2017 Ideal outdoor patio furnishings brands 2017 High end exterior dining tables contemporary patio area Manutti outside furnishings comes miromar style center Remarkable high-end exterior furnishings witsolut In short: Well, that's it-my friends.

Do not neglect to share this article around the planet.

Winston Furniture: Luxury Outdoor Patio Furniture in Florida, New York

Purchasing your first outdoor furniture is nearly as interesting as purchasing your very first house with a garden. Before you rush out to go shopping, put in the time to figure out the best all-weather pieces for your patio area, deck, or deck. I wish had (rather than finishing up with outside furniture that underwhelms).

Here are five points to understand prior to you select the ideal exterior furnishings for your house: 1. Economical furniture might end up costing you extra.

On the high end are merchants consisting of Design Accessible as well as Restoration Equipment (both of which offer single easy chair that choose upwards of $1,000) as well as on the low end are websites such as Overstock and also Walmart (where whole sectionals can be had for under $700). Presume where I finished up getting our outdoor furniture? Yep, tempted by the cost tag, I chose a synthetic wicker sectional I found on a price cut website during a late-night internet crawl.

Our sectional was so light-weight that, unless you rested down very gingerly, the seats would slide as well as the cushions would skate. Our pet dog, who is not the most elegant pet to start with, came to be so skeptical of the unsteady seating that he currently nervously paces our deck for a number of minutes prior to he collects the guts to enrich.

Best Outdoor Patio Furniture of 2021 - Crate and Barrel in Sarasota, Florida

The truly affordable things tends to be light-weight as well as flimsy. Some chair legs are too skinny for decks. Above: The thin legs on the wrought-iron chairs position no problems on this patio with pavers.

Prior to we bought a house with a yard, we lived in a small leasing that had a timber deck. It was our first little bit of outside area and also we liked it, dressing it up with planters, a Weber grill, an easy chair, as well as a vintage eating established that we scored at a yard sales.

We had to be watchful about putting the chairs so and constantly had to remind guests to do the samenot precisely the very best arrangement for spontaneity and fun. If you're looking for an exterior dining established for a wood deck, take into consideration the chair legs and see to it they won't get trapped in a space when you draw the chair out.

They only have a two-year guarantee and are as standard as a CPVC Adirondack chair obtains. Timeless comfortable style; Constructed of weather-resistant simulated...UV-protected will not break, chip or peel, Some assembly needed.

Malmo 18 Piece Outdoor Patio Furniture Combination Set In Natural – Shop4Patio.com

Malmo 18 Piece Outdoor Patio Furniture Combination Set In Natural – Shop4Patio.comSeat Size - 38. 6 inch.( 98 cm) ... The elegance of timber without the maintenance Last upgrade on 2021-10-11/ Affiliate web links/ Images from Amazon Product Advertising And Marketing API Seat Chair High-End Pick: Tropitone South Coastline Seat Chair Tropitone's South Beach line of easy chair are stunning but extremely expensive! We like the check out the vast range of shade options, but in this group, it's pretty clear that the Keter Pacific seat chairs gone over listed below are a better selection for all but the most rich, style-conscious customers.

Appliances Connection

Appliances Connection - AliExpress

- AliExpressThese chairs are rather comfortable, are made entirely of material wicker (even the bolts are material) as well as are totally water-proof and totally capable of surviving outdoors. They're also surprisingly low-cost. They won our leading choice amongst Outdoor Seat Chairs. Last update on 2021-10-12/ Affiliate web links/ Images from Amazon.com Product Advertising API Outdoor Daybed High-End Pick: Island Gale Two Person Outdoor Hanging Egg Chair Daybed This chair is spectacular! The Island Gale 2 individual hanging egg chair can function as a two-person loveseat, or as an (undoubtedly little) outside daybed.

Luxury outdoor furniture, Beautiful outdoor furniture, Outdoor furniture

Luxury outdoor furniture, Beautiful outdoor furniture, Outdoor furnitureWhen the cold climate comes on, you'll want to bring this chair inside and also use it by the fireplace! Last update on 2021-10-12/ Affiliate web links/ Pictures from Amazon.com Product Advertising API Budget Choose: Tangkula Outdoor Daybed, Round Tangkula's daybed is much extra conventional than Island Windstorm's, as exterior daybeds go.

The Top 10 Outdoor Patio Furniture Brands in Mattituck, New York

Located both in New Jersey and Florida, Patio World store offers the ultimate in high end outdoor & patio furniture. Enjoy famous, upscale brands at discounted prices. We offer large selection of green, natural and eco-friendly outdoor furnishings, as well as top-quality umbrellas, accessories and outdoor rugs, custom cushions & pillows. 1000 product groups in stock for immediate white-glove local delivery. Patio World means guaranteed lowest prices with unmatched personal service in your area.

, right into 4 various items, and can be made use of as a sectional conversation set, or patio Furniture sale sears can be attached together as an extremely comfy outside daybed. Tangkula markets a couple of various arrangements of this daybed, however the four-piece sectional is the finest, in our eyes.

Your outdoor space is an expansion of inside your home, so why deficient just as eye-catching? Our outdoor furniture helps you do simply that, with elegant seating, weatherproof furniture, and tables to create an extravagant yard refuge. Whether you choose relaxing seaside or modern-day minimalism, have a tiny patio or a vast lanai, we have actually got you covered with high-end backyard furnishings.

The Top 10 Outdoor Patio Furniture Brands

The Top 10 Outdoor Patio Furniture BrandsProduce a high-end hotel really feel with the tidy lines of our modern-day chaises and also daybeds, or attempt a rustic framed hammock for the utmost in solo relaxation. Our high-end patio furnishings collection additionally includes poolside, yard, and porch alternatives, each conveniently coupled with outdoor throw pillows and also accent tables for an impressive outside retreat.

That's why we carry just the highest-quality outdoor furniture from relied on brands like Talenti, Barlow Tyrie, and Gloster. Select items made from materials like light weight aluminum, teak, as well as fiberglass, covered with weatherproof pillows developed to withstand fading as well as mold. Produce your dream domain name with luxury yard furniture developed to last.

Located both in New Jersey and Florida, Patio World store offers the ultimate in high end outdoor & patio furniture. Enjoy famous, upscale brands at discounted prices. We offer large selection of green, natural and eco-friendly outdoor furnishings, as well as top-quality umbrellas, accessories and outdoor rugs, custom cushions & pillows. 1000 product groups in stock for immediate white-glove local delivery. Patio World means guaranteed lowest prices with unmatched personal service in your area.

If you have an outside room, you have actually most likely located on your own wanting solution to this concern eventually, and in this write-up, we're intending to assist you narrow down your search. One of the most effective ways to transform your garden or patio into a room you delight in hanging out in is to provide it.

High End Manufacturers of Outdoor Patio Furniture - The ... in Hackettstown, New Jersey

So we've checked the net, analyzed lots of evaluations, as well as asked a couple of furniture experts and developers to chip in and assist us find the most effective exterior furnishings business to purchase from in 2021. Whether you're looking for a modular couch that'll offer you that kicking back living area feeling outdoors, the excellent eating established for an alfresco meal, or lounge chairs to crash out in on those warm summertime mid-days, you'll be sure to find what you're trying to find with one of the brands provided below.

Neighbor has a variety of outside items including sectional couches, seats, armchairs, exterior coffee tables, as well as accessories like exterior cushions. Each product is made with sustainably collected FSC certified teak timber, Sunbrella Fabrics, and weather-resistant high-density, reticulated foam.

Next-door neighbor's mission is to help people create exterior areas for connecting with household, close friends, as well as next-door neighbors. The brand name was established by 3 close friends with a goal to help individuals change their lawn area right into outdoor living space.

Attractive, top quality outdoor furnishings at truthful prices. Sofas, seats outside dining sets, chaises, as well as accessories. Patio area furnishings sets from $1,980.

Top Rated - Patio Furniture - Find Great Outdoor Seating ... in McGuire AFB, New Jersey

Founded by father-son duo Bob and Jay Dillon in 2017, Yardbird was introduced to bring environment-friendly as well as cost effective exterior lounge furnishings directly to consumers. The Dillon's located that when it pertains to the outdoor furnishings market, most consumers really feel trapped into acquiring premium collections at exorbitant costs or scrap from big-box stores that call for hours of assembly.

The Minnesota-based brand has a solid focus on sustainability as well as in 2020 it included over 150,000 lbs of plastics collected from coastlines, waterways, and highly prone places in the Philippines product right into its furnishings and also packaging. Outer is on an objective to aid people take pleasure in the basic high-ends that our backyards, decks, as well as patios need to use.

/cdn.vox-cdn.com/uploads/chorus_asset/file/19930260/BretonBlackMetalSofaOLB20.jpg) Best Luxury Outdoor Furniture Brands - 2021 Update

Best Luxury Outdoor Furniture Brands - 2021 UpdateCouches from $3,550. For delivery quotes, ask on Outer's website. Free shipment on all orders. Founded by Terry Lin and also Jiake Liu, Outer wishes to aid people take advantage of their outdoors rooms. Its owners understood that as we have actually become familiar with living our lives indoors from our homes to our workplaces and also the commutes in between we've neglected how crucial top quality time outdoors can be.

The finest of contemporary furniture, valued for genuine life. Possessed by Wayfair, All, Modern has a massive array of comfortable outdoor patio furniture.

8 Amazing High-End Outdoor Furniture Brands - Best Interior ... in Clearwater, Florida

It has one of the largest series of exterior furniture you'll discover online, with thousands of items prepared to ship right away. All, Modern has tons of attractive, supremely economical contemporary wood as well as cast aluminum furniture collections but you'll usually locate a sale on too, so watch out for a deal.

West Coast-inspired garden furniture and also design. Outside couches, wicker as well as teak collections, benches, tables, as well as outside devices. Chairs for around $800, 3-seat couch from $1,885.

Orders between $1,000-$2,499 ship for $145. Orders between $300-$999 ship for $95. Ajna Living desires to make outdoor furniture shopping simple. Its products are crafted through years of study as well as every thing is developed to be super comfortable, look terrific on your patio area, and endure the elements for several years ahead.

With most of its pieces in stock and also all set to deliver, Ajna Living purposes to obtain your brand-new furniture to your door in days, not weeks. Find out more and shop currently at Furnishings developed for maintaining. Floyd's exterior furnishings was created in collaboration with Brooklyn-based layout workshop Uhuru and also functions exterior tables, benches, and chairs.

Jensen Outdoor - Sustainable Luxury Wood Furniture in East Rockaway, New York

Floyd's outdoor pieces are designed to withstand the components as well as give comfy outside seating as well as dining options whether it's for a family Barbeque on a warm mid-day or a freezing winter season drink with good friends around the fire pit."We have an affinity for optimistic layout.

Modern Luxury Outdoor Patio Furniture With High End Outdoor – layjao

Modern Luxury Outdoor Patio Furniture With High End Outdoor – layjao"Each piece is unified by a strong graphical silhouette that is solid without being bulky, and also sophisticated without being delicate. The Exterior Establish is extra resilient, fulfilling contract-grade BIFMA criteria to make it the ideal choice for public areas or any type of room that takes a beating. Floyd's Outside Establish is developed to be weatherproof - completely water-resistant and also slatted to ensure that no rain ever before collects."Transport your dining-room outside with Floyd's exterior table and bistro set which is ideal for a moonlit dinner or brunch.

Its outdoor chairs include an unique, comfortable curvature that gives the best rest as well as they are made to quickly stack to save area when not in use. The Outdoor Bench is a flexible piece that can be made use of as a seating option and additionally double up as an exterior coffee table.

AuthenTEAK

AuthenTEAKFrontgate has a broad choice when it pertains to exterior living furnishings including wicker, light weight aluminum, as well as teak wood seats collections and sunlight loungers, Adirondack chairs, veranda swings, and also chaise lounges. Exterior sofas from around $1,300. In-stock items will usually get here in 3-7 business days. Orders varying between $200. 01 to $2,700 ship for 11% of the overall order value.

Patio & Outdoor Furniture - Costco in Mattydale, New York

01 ship for an established charge of $299. Considering that 1991, Frontgate has actually used a wide variety of practical, high end outdoor furniture. It offers both its own-brand products as well as likewise supplies several of the very best outdoor patio furnishings and also devices from some wonderful brands. "They use good design as well as high quality at a reasonable cost factor," says developer Pamela O'Brien that advises its Baleares Day Bed "to include a touch of resort-style" to your outdoor room.

It additionally uses a variety of water-resistant furniture covers to help secure your furnishings from mold, fading as well as splitting in the sun, and freezing temperatures throughout the off-season. Antique top quality pieces that can be given for generations. Arhaus has an array of outdoor sofas, daybeds, chairs, shaking chairs, dining sets, as well as outdoor design.

Founded in 1986 on environmentally aware ideas, Arhaus is committed to developing heirloom-quality, premium outside furnishings items that can be passed down for generations. Whether you're looking for furnishings for your porch, pool, or outdoor patio Arhaus will have something to fit your requirements as well as help you slide into trip mode in the convenience of your own room.

com.Elevated basics as well as desired statement pieces for a passionate house. From outdoor coffee tables and chairs to outdoor sofas and also sectionals, Lulu & Georgia's outside collection has something for everyone. Outside accent chairs from around$1,400, couches from around$2,700. Shipping timelines on many things are up to 14-18 organization days. 01 as well as above are charged 10%of the product

Teak Warehouse: Buy Teak, Wicker, and Outdoor Furniture in Pawtucket, Rhode Island

total. Based in Los Angeles, Lulu as well as Georgia makes and also curates a series of residence decor and also furnishings intended at awakening your creative spirit. Clean lines, natural tones, and also great white contrasts lend Lulu & Georgia's exterior patio area furniture collection a classic, Mediterranean-inspired appeal. "They are constantly current with what is in style - premium patio furniture

."Its contemporary exterior furnishings collection includes everything from chaises as well as outside lounge chairs, to sofas, chairs, eating collections as well as patio tables, carpets, pillows, as well as even hammocks. Influenced living via top notch products, unique styles, and also timeless style. Outdoor chairs, sofas, chaises, coffee tables, as well as much more. Exterior sofas from around $1,500. In-stock items can.

show up within 3-5 business days. Orders of $220. 01 and above are billed 10%of the goods total. Whatever exterior furniture room you have, Cage & Barrel will have something to suit your needs in its patio furniture collection. Recognized for its indoor furniture, Pet crate & Barrel brings the very same level of information as well as top quality to its versatile patio furnishings. What truly makes Crate & Barrel stand out is the large choice readily available to its customers.

Article's outdoor furnishings collection consists of an array of outside lounge items, yard eating collections, as well as small finishing touches and also accessories like umbrellas, illumination, and cushions to finish your outdoor living room. Outside sofas readily available for under$1,000. Article has something for any person trying to bring the feeling and also comfort of indoor furniture outdoors.

Its ageless furnishings will last several summers and constantly remain in style as well as numerous pieces are also very cost effective with some smaller sized exterior sofas offered for under$1,000. If you're a follower of alfresco dining, Article additionally has a variety of exterior eating collections made from strong teak to weather-resistant steels."I've directly functioned with Write-up, it brings quality, on-trend outside furnishings, "states Kelly Marohl, owner and also developer of The Greenspring House."We have the driftwood grey Tavola outside table in our home, and also the teak wood is definitely spectacular in person! Mostly all of my guests discuss how much they love the look of it."Rove Concepts concentrates on mid-century, modern Nordic, as well as modern furnishings style and also has collections of interior as well as outside furniture. Rove Concepts has a variety of exterior modular couches, accent tables, patio chairs, as well as outside feceses. Outdoor sofas from around$1,200. United States common shipments have actually an approximated 5-14 business days, Canadian basic shipments have an estimated 6-16

days. Rove Concepts uses tiered flat price delivery to Canada and also the United States except for Hawaii, Alaska, Puerto Rico, and also Nunavut. Its sensational sectionals and also sofas bring the vibes and also comfort of indoor furniture to your outdoors space and also wouldn't watch out of put on a luxury resort. Each of its exterior pieces is made from premium products consisting of fast dry foam cushion, UV immune textile, and also teak wood

Outdoor Furniture - Luxury Patio Furniture & Accessories in Orangeburg, New York

Some pieces additionally have detachable pillows. Hay's original furniture designs include elegant geometric layouts with a combination of aesthetic simplicity and core toughness. Its chairs, sofas, as well as feceses are made from weatherproof powder-coated steel and crafted to withstand the elements. Budget friendly furniture that occupies the happy medium between high-end and alsosensibility. Almost every item of patio area furnishings you could ever before need, Harmonia Living offers seating, tables, storage, and also accessories. Based in San Diego, The Golden State, Harmonia Living was substantiated of disappointment with the outdoor patio furniture industry. Similar to Neighbor's tale, Harmonia Living's creators realized the industry was loaded with elegant, premium brand names that are also costly or economical brands with unstable items, so they set out to develop a brand name between ground premium quality, however economical outside furnishings."This brand supplies elegant, inexpensive outdoor furniture that will last. ""Its furnishings has all the elements of the premium brands: Heavy-Duty Powder-Coated Aluminum Frameworks, HDPE(high-density polyethylene)Wicker, Sunbrella textiles, as well as Dacron-Wrapped Foam Core paddings but at a reduced and also cost effective cost," she includes. Harmonia Living's outdoor furniture sets are readily available in a number of upholstery designs so you can include a pop of color to your exterior living space.Learn more and store currently at harmonialiving. Chairs and seats from$2,500. In-stock products will generally be provided 3-5 days from the day that they deliver (using Decoration Interiors). Free delivery(by means of Decor Interiors)."Mamagreen is one of the most effective outside furnishings brand names on the marketplace because the business integrates cutting-edge layout with sturdy materials and coatings, "says Expense Ferris from Style Interiors. What to Search for in a High-Quality Outdoor Furnishings, So what should you search for in great exterior pieces? There's no one-size-fits-all method to specify"finest ", it depends a lot by yourself one-of-a-kind feeling of style, and spending plan. There are a couple of points you must always keep an eye out for though: Always check the materials made use of by each brand. Trustworthy exterior furnishings companies will constantly supply great guarantees on their items (for instance Outer offers a 10-year guarantee on its light weight aluminum structure as well as legs and five years on its wicker as well as paddings) What have various other clients said regarding this brand? Way too many unfavorable reviews could be a warning. A lot of the time, online consumers don't have an opportunity to look into products in person, so the imagery on a site is vital. The very best suppliers provide shots of their products from different angles, in several shades, up close, and also in