Lamson Gennie blogüzenete

Without appropriate records, companies run the chance of ending up with an excessive amount of or too little inventory levels. ECommerce businesses ought to know their stock levels always. The property of your eCommerce business include tools, stock, and cash funds. The liabilities include excellent mortgage funds or enterprise loans. But merely starting an eCommerce business might not guarantee your success. To get by way of this competition, managers should pay attention to their eCommerce bookkeeping.

Without appropriate records, companies run the chance of ending up with an excessive amount of or too little inventory levels. ECommerce businesses ought to know their stock levels always. The property of your eCommerce business include tools, stock, and cash funds. The liabilities include excellent mortgage funds or enterprise loans. But merely starting an eCommerce business might not guarantee your success. To get by way of this competition, managers should pay attention to their eCommerce bookkeeping.

Is bookkeeper larger than accountant?

The Bottom Line

Bookkeepers don't necessarily need larger schooling in order to work of their subject while accountants can be more specialised of their coaching. Another key distinction is their pay scale. Because bookkeepers are most likely to work for smaller firms, they is most likely not paid as a lot as accountants.

Real-time tax reporting helps get rid of clutter and time wasted looking for receipts, decreasing the stress of tax preparation. There is a date when somebody makes an order and when that cost is processed or settled, so the exchange price might change throughout that point. Without an skilled bookkeeper, overseas sales could create discrepancies in your books.

An Unbiased View of best bookkeeping software for ecommerce

They don’t show the complete picture when you’re making necessary monetary selections for your ecommerce retailer. The solely downside of money foundation accounting is that it does not account for future receivables and payables. But if you’re utilizing the best ecommerce accounting tools, you'll find a way to nonetheless plan for these using different reports at your disposal. You can use ecommerce accounting reports and money flow statements to predict both short-term and long-term revenue. Early on, new ecommerce businesses would possibly manage this stuff by hand or using a spreadsheet. You should have your ecommerce accounting methods in place from day one—making it easier for your business to scale.

The Pain of bookkeeper ecommerce

You’ll discover hints and ideas throughout this text on choosing the right ecommerce accounting resolution for your corporation. Accounting for ecommerce companies is vital to understand cash circulate and profitability. You need a sturdy system in place to manage your incomings and outgoings. That data lets you perceive your business’s efficiency and tax liability. You additionally should deal with delivery, returns, chargebacks, and all the remainder. Most ecommerce platforms sell lower-priced merchandise, and deal in volume.

The Hidden Gem Of bookkeeping for ecommerce business

If you initially operated out of a warehouse, then bought that space and moved right into a smaller one, revenue from the sale can be thought of non-operating income. The same could be true if you made a revenue from reselling gear like a stitching machine or if your organization obtained dividends from an funding of its funds. In the opposite column, you should record your liabilities, which include such things as money owed and money you owe for business-related causes. Once your new store has been arrange and goes reside on the internet, you will need to guarantee that your inventory ranges are enough and that bills are tracked, amongst different concerns.

Another important level to remember is that the delivery fees you charge clients typically won’t match up perfectly with what you pay to ship those gadgets. For instance, let’s say you offer a flat rate of $5 shipping — you could pay $2 to ship one order and $10 to ship one other. Some e-commerce platforms make dealing with shipping logistics simpler by integrating immediately with transport techniques. That means your platform can handle collecting shipping costs from the shopper and purchasing postage out of your logistics supplier. However, keep in mind that whereas that’s one much less step for you to worry about, your e-commerce provider will doubtless take a reduce from the transaction. Alternatively, you'll have the ability to decide to work with professional ecommerce accounting firms which are well-versed in Singapore’s accounting requirements and laws.

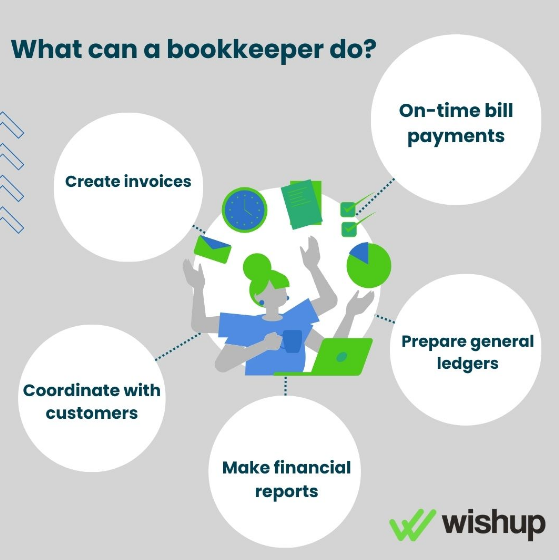

While Xero and QuickBooks each have a default chart of accounts, this isn’t designed for the complexities of eCommerce businesses. Having a bookkeeper might help you set up and manage your chart of accounts. Accounting guidelines and tax rules differ by country and state, so staying updated is crucial to your success. Even if accounting isn’t your sturdy point, there are a few simple tips to follow for managing a clean ecommerce operation. You can earn interest in your balance, however bear in mind this is counted as income and is topic to tax. There can also be restrictions on withdrawals from financial savings accounts.

A cash circulate assertion shows the cash coming into and going out of a enterprise in a certain period of time. The most common format is a monthly view, which exhibits historic data and a forecast for the future. It’s a key report and the one you’re likely to take a glance at most regularly. Like any enterprise, managing an ecommerce company comes with appreciable bills. You can plan and collect some of them, like delivery prices or cybersecurity protection.

Accounting for an ecommerce enterprise is an important a half of working a profitable on-line store. It helps you perceive your business’s financial state of affairs, make smart choices, and stay compliant with tax regulations. All this can make managing accounting for ecommerce companies in Singapore daunting.

This enables eCommerce business house owners and managers to watch their store’s efficiency in real-time, make data-driven selections, and determine developments and opportunities for development. By providing a complete overview of the business’s health, an eCommerce dashboard is an important component for https://xerosetupforamazonsellers.s3.de.io.cloud.ovh.net/xerosetupforamazonsellers/index.html efficient eCommerce accounting and strategy development. While you may begin with Excel or Google Sheets, investing in ecommerce accounting software program like Xero or QuickBooks Online can save time as your business grows. These tools assist observe sales, expenses, inventory, and taxes, and so they generate important financial reviews.