Mcclellan Dane blogüzenete

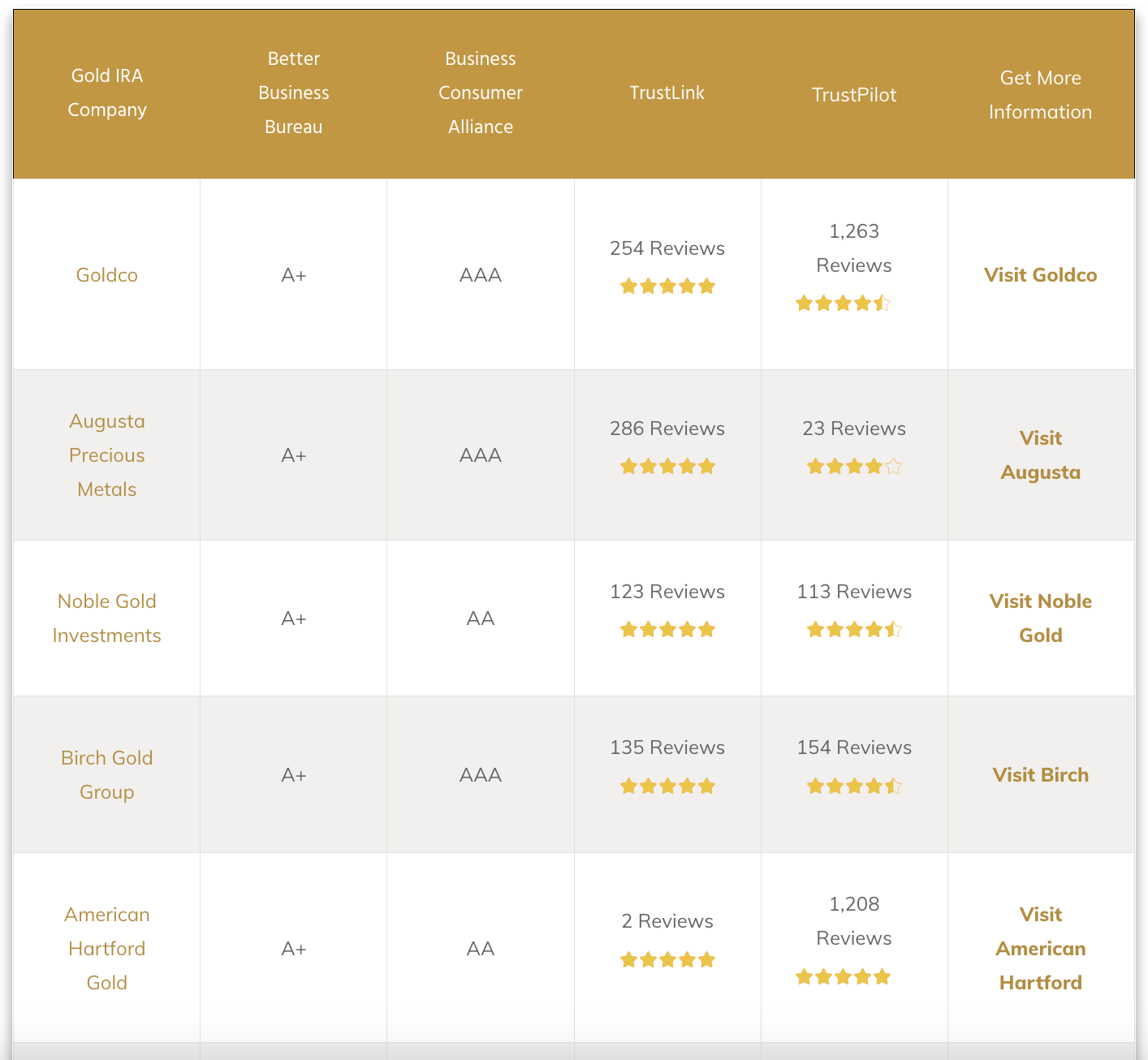

It is important to note that the gold you personal in your Fidelity Gold IRA is stored with a 3rd-celebration custodian called FideliTrade, which ensures its safekeeping. This can be a special kind of particular person retirement account that permits you to invest in a broad variety of unconventional assets, together with valuable metals, real estate and even cryptocurrency. Goldco affords a wide range of investment choices together with Roth IRAs and 401(ok),s as well as different retirement accounts. As well charges, and metal choice determine scores. With Birch Gold Group, you may access an intensive range of products and services, as well as a group of experienced professionals to information you every step of the best company to rollover ira to gold way. Step 3: When you're able to proceed, an account consultant will guide you thru your complete process by way of phone. The value of your gold IRA will increase and lower based on the gold market.

It is important to note that the gold you personal in your Fidelity Gold IRA is stored with a 3rd-celebration custodian called FideliTrade, which ensures its safekeeping. This can be a special kind of particular person retirement account that permits you to invest in a broad variety of unconventional assets, together with valuable metals, real estate and even cryptocurrency. Goldco affords a wide range of investment choices together with Roth IRAs and 401(ok),s as well as different retirement accounts. As well charges, and metal choice determine scores. With Birch Gold Group, you may access an intensive range of products and services, as well as a group of experienced professionals to information you every step of the best company to rollover ira to gold way. Step 3: When you're able to proceed, an account consultant will guide you thru your complete process by way of phone. The value of your gold IRA will increase and lower based on the gold market.

Additionally, Birch Gold Group companions with a number of the business's most reputable names, including Equity Trust Company and STRATA Belief Company. Moreover, customers have praised Birch Gold Group for their in depth knowledge and transparency in the gold market, permitting purchasers to make knowledgeable selections with full confidence. Custodian charges. Just like every other IRA, you’ll have annual prices and charges related to transactions and property. 2019t generate earnings or dividends like stocks and bonds do. Gold IRAs are similar to conventional investment IRAs with a number of exceptions, notably that a gold IRA holds physical metal. But, you only want to fulfill the required $20,000 minimal to open an IRA. Augusta provides flexibility by allowing you to choose your own custodian and storage provider. The IRS additionally has rules on the physical belongings you'll be able to hold in your gold IRA. In our example, it takes 30 ounces of silver to buy one ounce of gold. For example, let's assume that the value of gold is $1,500 an ounce in the present day. So except the price of gold has significantly increased since you bought it, you might lose a portion of your investment.

Additionally, Birch Gold Group companions with a number of the business's most reputable names, including Equity Trust Company and STRATA Belief Company. Moreover, customers have praised Birch Gold Group for their in depth knowledge and transparency in the gold market, permitting purchasers to make knowledgeable selections with full confidence. Custodian charges. Just like every other IRA, you’ll have annual prices and charges related to transactions and property. 2019t generate earnings or dividends like stocks and bonds do. Gold IRAs are similar to conventional investment IRAs with a number of exceptions, notably that a gold IRA holds physical metal. But, you only want to fulfill the required $20,000 minimal to open an IRA. Augusta provides flexibility by allowing you to choose your own custodian and storage provider. The IRS additionally has rules on the physical belongings you'll be able to hold in your gold IRA. In our example, it takes 30 ounces of silver to buy one ounce of gold. For example, let's assume that the value of gold is $1,500 an ounce in the present day. So except the price of gold has significantly increased since you bought it, you might lose a portion of your investment.

The price of gold has risen throughout the centuries. Gold is that shiny and alluring steel that has captivated humanity for centuries. Dodson said apart from the requirement that valuable metals have to be shipped immediately from the treasured-metals dealer to the depository, IRS guidelines governing IRAs specify that precious steel IRAs can only hold gold, silver, platinum and palladium bullion products. But they could also be a bit increased for a gold IRA-especially when utilizing a distinct firm than the one managing your other retirement accounts. Customers can diversify their portfolios in response to their threat tolerance and preferences through the use of the company's valuable-metals IRA. Whether or not you need to get a gold IRA depends on a number of factors, including your threat tolerance, financial plan and time horizon. If diversifying your retirement plan is a precedence, then a gold IRA could also be worth trying into. Step 2: Once you've got assessed all of your retirement property, you may determine the function of a precious metals IRA in your general plan. Step 4: Inside a number of weeks, your assets will be liquidated and the funds transferred to Goldco. This step is essential since it permits you to choose which metals to invest in and the way much. Those trying to continue rising their retirement funds, then, could shortchange themselves if they personal too many valuable metals.

A metals IRA helps safeguard your laborious-earned financial savings from being slowly depleted. By contributing to a Roth IRA, you possibly can probably take pleasure in tax-free withdrawals in retirement, allowing you to maximise your savings and doubtlessly scale back your tax burden. "A valuable metallic IRA may have more fees than a traditional IRA, together with setup charges, transaction fees, custodial charges and bodily asset storage charges," he warns. In our research we discovered that while many companies advertised low account charges, they charged a significant markup on gold and were not clear on custodian charges. Analysis and evaluate firms: Start by researching reputable gold IRA companies. Evaluate storage options: Research the corporate's storage methods. This coincides with constructing a funds and bearing in mind any upcoming storage or insurance fees. A one-time account setup payment can vary from $50 to $150. Account setup fees. A one-time charge is charged to arrange your new gold IRA account. This fee can differ depending on the monetary institution. Each of these entities charges charges for his or her companies, which might differ widely. Unfortunately, this can't be performed using conventional custodians within the brokerage trade. Brokerage Providers Obtainable By way of And so on Brokerage Providers, Member SIPC, and FINRA.

American Hartford Gold additionally affords Monetary Planning Providers. Trust corporations aren’t fiduciaries, so they cannot suggest dealers or depositories, he mentioned. They involve a custodian, a seller (or sellers), and a depository. Gold IRA companies are literally a mix of three corporations in that there is a custodian, a vendor, and a depository that could be affiliated but operate independently with their very own practices and charges. Selling charges. When promoting your gold to a third-celebration supplier, remember that the supplier will usually offer you lower than the present market worth. Make your purchase figuring out your metals can be safely shipped, stored, and confirmed by the Augusta team. Having your funds in gold also helps scale back losses if the financial system-particularly the inventory market-takes a turn.