Fuentes Allison blogüzenete

These varied Gold IRA options supply flexibility to go well with particular person monetary circumstances and goals. Higher maintenance charges come from extra costs that are not current with other types of IRAS (brokerage charges, account setup charges, paying the IRA-accepted custodian, markup, storage and insurance). Investors and savers can open gold IRAs by means of a specialised precious metals IRA company or by a custodian (a financial institution or brokerage agency that manages the account). To open a Fidelity Gold IRA account, it's good to have a sound government-issued ID and meet the minimum funding requirement of $2,500. Gold mining corporations are another funding choice however these stocks don’t all the time observe gold’s long-time period efficiency very closely. We offer access to rare pieces that the majority dealers can't, all at the very best costs with quick service. The disadvantage is the time spent looking for invaluable pieces. 1. Diversification: Gold serves as a valuable diversification tool within a retirement portfolio. Why Has Gold At all times Been Valuable? This sort of IRA is instantly managed by the account holder, which is why it’s called a self-directed IRA. A self-directed individual retirement account is an IRA that allows alternative investments for retirement savings.

Opening and funding a Fidelity Gold IRA is a simple process. There are not any age restrictions for opening an account, making it accessible to investors of all ages. Sure, Fidelity affords a gold IRA, however there are limitations on the sorts of gold allowed within the IRA, restricted to Gold American Eagle and Gold American Buffalo coins in response to federal legal guidelines and restrictions. Investing in these types of companies will be an efficient method to revenue from gold and may carry lower threat than different funding methods. Nonetheless, jewelry ownership offers an enjoyable solution to own gold, even if it's not probably the most worthwhile from an funding standpoint. When the value of forex declines as a consequence of inflation, the purchasing power of gold often remains relatively stable and even increases. Should you loved this informative article and you wish to receive much more information about best companies for gold ira rollover (https://luxuriousrentz.com/how-do-you-find-medical-doctors-that-settle-for-the-humana-gold-plus-insurance-coverage-plan) generously visit our web-page. However, the analysis into and collection of individual firms requires due diligence on the investor’s part. A Gold IRA, or Particular person Retirement Account, is a specialised retirement funding that enables individuals to diversify their retirement savings by together with physical gold and different valuable metals of their portfolio.

Opening and funding a Fidelity Gold IRA is a simple process. There are not any age restrictions for opening an account, making it accessible to investors of all ages. Sure, Fidelity affords a gold IRA, however there are limitations on the sorts of gold allowed within the IRA, restricted to Gold American Eagle and Gold American Buffalo coins in response to federal legal guidelines and restrictions. Investing in these types of companies will be an efficient method to revenue from gold and may carry lower threat than different funding methods. Nonetheless, jewelry ownership offers an enjoyable solution to own gold, even if it's not probably the most worthwhile from an funding standpoint. When the value of forex declines as a consequence of inflation, the purchasing power of gold often remains relatively stable and even increases. Should you loved this informative article and you wish to receive much more information about best companies for gold ira rollover (https://luxuriousrentz.com/how-do-you-find-medical-doctors-that-settle-for-the-humana-gold-plus-insurance-coverage-plan) generously visit our web-page. However, the analysis into and collection of individual firms requires due diligence on the investor’s part. A Gold IRA, or Particular person Retirement Account, is a specialised retirement funding that enables individuals to diversify their retirement savings by together with physical gold and different valuable metals of their portfolio.

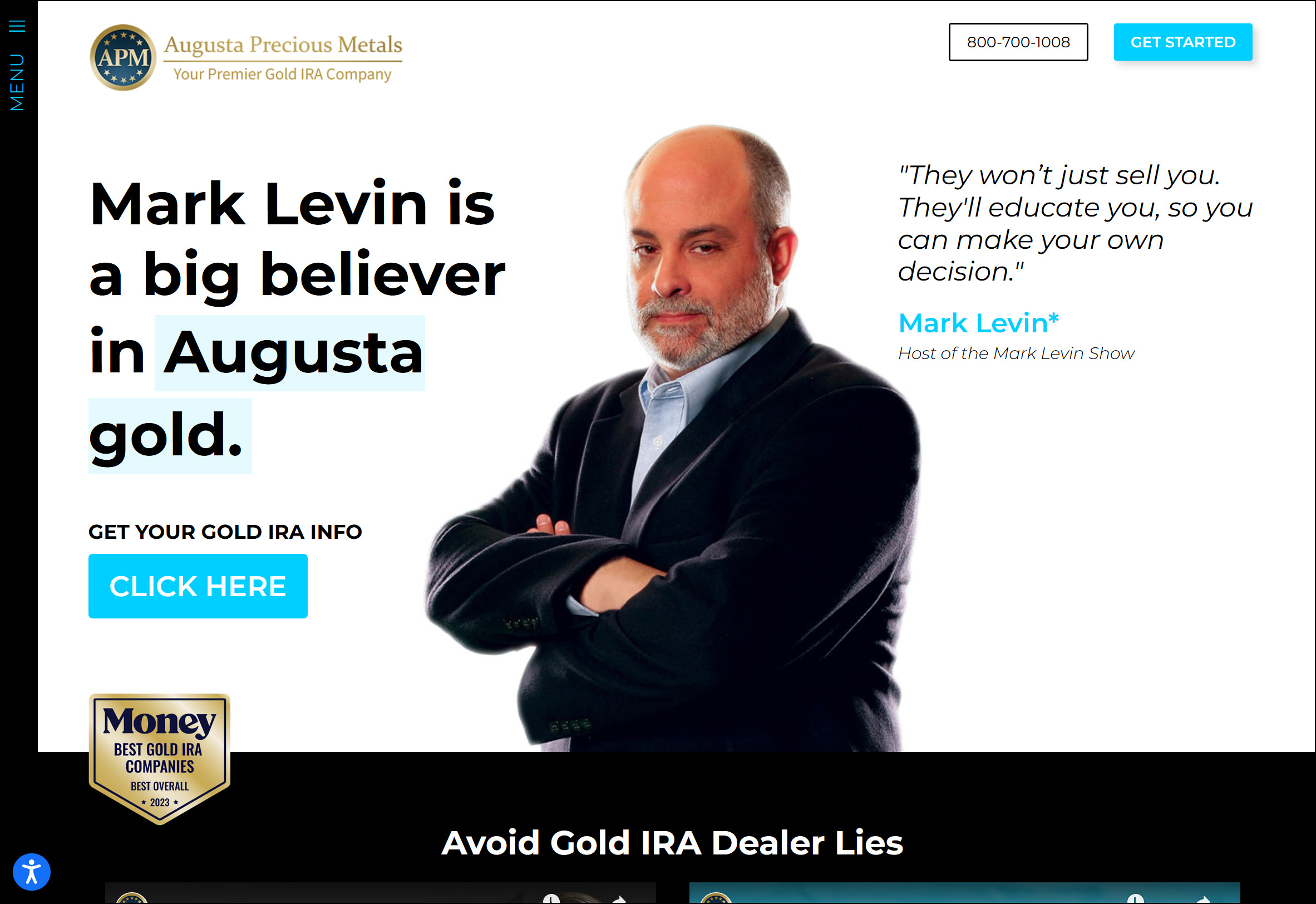

This can be notably interesting to people seeking to safeguard their retirement savings and add an additional layer of safety to their funding technique. They supply distinctive funding choices past conventional stocks, bonds and mutual funds. It involves creating an account online, providing obligatory paperwork, and making the minimum preliminary funding. They're both a good selection for starting investors due to their low value and low minimal funding requirements. It is especially appropriate for beginning investors or those looking to handle their own investments. Whether you’re studying about gold IRAs for the primary time or looking to expand your data, these sources can assist you make informed investment selections. Treasury-minted coin. You don’t need a custodian and also you don’t need to pay storage fees to a depository. Although Fidelity doesn’t have its personal gold ETF, they facilitate investing in quite a lot of gold ETFs and mutual funds. Lifehacker has been a go-to source of tech assist and life advice since 2005. Our mission is to offer reliable tech assist and credible, practical, science-based mostly life advice to help you reside better. You might want to supply payment plans to shoppers. Note: for those who determine to open your gold IRA with an organization like Augusta Treasured Metals they will allow you to pick where you want your bullion to be stored.

This can be notably interesting to people seeking to safeguard their retirement savings and add an additional layer of safety to their funding technique. They supply distinctive funding choices past conventional stocks, bonds and mutual funds. It involves creating an account online, providing obligatory paperwork, and making the minimum preliminary funding. They're both a good selection for starting investors due to their low value and low minimal funding requirements. It is especially appropriate for beginning investors or those looking to handle their own investments. Whether you’re studying about gold IRAs for the primary time or looking to expand your data, these sources can assist you make informed investment selections. Treasury-minted coin. You don’t need a custodian and also you don’t need to pay storage fees to a depository. Although Fidelity doesn’t have its personal gold ETF, they facilitate investing in quite a lot of gold ETFs and mutual funds. Lifehacker has been a go-to source of tech assist and life advice since 2005. Our mission is to offer reliable tech assist and credible, practical, science-based mostly life advice to help you reside better. You might want to supply payment plans to shoppers. Note: for those who determine to open your gold IRA with an organization like Augusta Treasured Metals they will allow you to pick where you want your bullion to be stored.

However, if you are not capable of utilize the assertion credits or want additional journey-specific benefits, you may possible get better value from a distinct card. Nevertheless, American Hartford Gold fees the next annual fee for providers corresponding to storage and insurance coverage. You can withdraw funds at any time penalty-free and tax-freeYou can withdraw money from a SEP gold IRA without penalty when you reach age 59 1/2. In the event you withdraw funds earlier than then, you will have to pay taxes on the cash withdrawn and face a 10% penalty. Early withdrawal rules- When you withdraw funds earlier than age fifty nine ½, you’ll face a 10% penalty tax. EligibilityEligible if you've got earned incomeYour income must be beneath a certain restrict ($228,000 for married couples filing jointly for tax year 2023 and $153,000 for people)self-employed individuals, small-enterprise homeowners and employees of small businesses. Whereas it is feasible to take bodily possession of gold held in a Gold IRA, there are necessary issues to keep in mind. Setting up a gold IRA account isn't possible with traditional custodians like standard brokers. Pro tip: properly setting up a gold IRA on your own is difficult. Professional tip: On a checkbook IRA you’re allowed to purchase and hold gold American Eagles, a U.S.